BMO InvestorLine Self-Directed review

Money.ca / Money.ca

Updated: August 08, 2023

Best for:

- DIY investors

- Multiple account types

- Holding USD in registered accounts

- Performing Norbert’s Gambit to convert USD/CAD

- Sophisticated market research and performance tools

About BMO InvestorLine Self-Directed

BMO InvestorLine Self-Directed is considered to be one of the top discount brokers in the country, especially after the platform’s recent redesign. Self-directed clients can open every account type imaginable at BMO InvestorLine Self-Directed, including RRSPs, TFSAs, non-registered accounts, corporate accounts, LIRAs, and more. Inside these accounts, investors can easily trade stocks and ETFs on all major exchanges, plus purchase mutual funds and bonds, trade options, and buy GICs. Another plus: you can buy and sell over 80 of the most popular ETFs for free.

BMO InvestorLine Self-Directed fees

Like many big bank brokerages, BMO InvestorLine Self-Directed charges a flat fee of $9.95 per trade (for stocks and ETFs). You can also buy and sell a selection of Canada’s most popular ETFs commission-free.

There is no minimum amount required to open an account, but there is an annual administration fee of $100 for registered plans with assets less than $25,000. Note: this fee is waived until December 31 the year when the account is opened.

A $25 fee per quarter will be charged on non-registered accounts with an account balance of less than $15,000.

But if you make two or more commissionable trades in six months, the fees are waived.

Experienced traders, those making more than 15 trades per quarter, can access the BMO 5 Star Program that offers preferred pricing, professional-level tools and research, and dedicated “5-star” support.

BMO banking clients can also quickly toggle between their online banking and InvestorLine platforms, making it easy for investors who prefer everything under one umbrella.

Pros and cons

Pros

-

Trade 80+ ETFs for free--Buy and sell a selection of Canada’s most popular ETFs without paying commissions

-

Comprehensive investing platform with access to every account type and investment product

-

USD registered accounts to trade U.S. listed stocks and ETFs

-

No minimum account balance required to open an account

-

Top-notch research tools and performance reporting

-

Seamless linking for BMO banking clients

-

5 Star Program for experienced traders

Cons

-

$9.95 per trade for stocks and many ETFs

-

$100 account fee for registered accounts worth less than $25,000

-

$25 per quarter fee for non-registered accounts worth less than $15,000

Key features

- Select Commission-free ETF

You can buy and sell a selection of Canada’s most popular ETFs without paying commissions.

- Research and performance tools

Get real-time data, research, and alerts, and easily view your accounts, holdings, quotes, and dividend information.

- Wide range of account types

Open any account type, from RRSP/RRIF, TFSA, LIRA/LIF, non-registered, corporate, and trusts.

- USD registered accounts

Ability to hold USD inside registered accounts to access U.S. listed stocks and ETFs without incurring foreign transaction fees. With many other brokerages, you’ll need accounts for CAD and USD, but with BMO InvestorLine Self-Directed, you can hold CAD and USD cash and investments in the same account.

- 5-Star Program

Preferred pricing, level two market quotes, dedicated 5-Star support, exclusive IPO allocation, and more for experienced traders.

- Transfer fees covered

BMO InvestorLine Self-Directed may reimburse transfer fees up to a maximum of $200.

- Mobile Trading App

The BMO InvestorLine mobile app gives clients the flexibility to trade stocks, ETFs, mutual funds, and even options on the go. Trades are protected with the latest encryption software and automatically synced with your web trading account.

- Good customer service

If you have questions about trading, investing, or other topics, you can phone the customer service line on Monday to Friday, between the hours of 9 am to 5 pm. However, like many online brokers, expect long wait times for call centre support, as BMO InvestorLine Self-Directed deals with unprecedented demand for self-directed investing. The better option is to schedule a call back with a BMO InvestorLine representative or book an appointment at a BMO branch to talk about investing with BMO InvestorLine Self-Directed.

- Low annual fees

Small investors will pay $50 per year for registered accounts with balances under $25,000, and pay $25 per quarter for non-registered accounts with a balance under $15,000.

- Sleek, user-friendly platform

With the redesign, the BMO InvestorLine Self-Directed platform offers an excellent user experience and is incredibly reliable. It rarely crashes or “goes down” — a biggie for DIY investors.

Learn MoreHow does BMO InvestorLine Self-Directed compare?

BMO InvestorLine Self-Directed compares favourably against other big bank discount brokerage arms like RBC Direct and TD Direct Investing. Its flat fee pricing of $9.95 is typical of other big bank investing platforms, but not a deal-breaker for infrequent traders. Also, the fact that you can buy and sell select ETFs for free is a win for DIY investors.

BMO InvestorLine Self-Directed does have a couple of other strong features, including the ability to hold USD in registered accounts. That’s ideal for investors who trade in U.S.-listed stocks and ETFs. Also, newer platforms like Wealthsimple Trade don’t have as comprehensive a line-up of account types, or the research and performance data that comes with a brokerage like BMO InvestorLine Self-Directed. As one of the oldest banks in Canada, BMO is also an institution you can trust.

| Broker | Cost per trade | Cost per ETF purchase | Options contract | Registered account fees |

|---|---|---|---|---|

| BMO InvestorLine | $9.95 | $9.95 (select ETFs are free) | $9.95 + $1.25 per contract | $50 per year on accounts < $25,000 |

| Questrade | $4.95-$9.95 | $0 | $9.95 + $1/contract | $0 |

| Wealthsimple Trade | $0 | $0 | n/a | $0 |

BMO InvestorLine Self-Directed vs. Questrade

For an online brokerage, Questrade gets top grades for its low-cost pricing, including free ETF purchases and $4.95-$9.95 fees for buying and selling stocks. Big bank brokerages like BMO InvestorLine simply can’t compete on that pricing. Questrade also offers every account type and trading activity that BMO InvestorLine Self-Directed has to offer, making it a clear-cut winner in this comparison.

But if you’re the type of investor who prefers to keep all of their investments and accounts under one big bank umbrella, or you’re a BMO banking client, then BMO InvestorLine Self-Directed will certainly meet your investing needs. Just be mindful of the $9.95 per trade fee, as they can add up in a hurry.

BMO InvestorLine Self-Directed vs. Wealthsimple Trade

Wealthsimple Trade is Canada’s first and only zero-commission trading platform and investors are curious how it stacks up against big bank online brokers like BMO InvestorLine Self-Directed.

Unfortunately, newer platforms like Wealthsimple Trade don’t have as comprehensive a line-up of account types, or the research and performance data that comes with a brokerage like BMO InvestorLine Self-Directed. Wealthsimple Trade clients can only open RRSPs, TFSAs, and non-registered accounts.

That said, investors who want to avoid the account fees imposed on small balances, as well as the $9.95 per trade fees, could do well with a no-frills platform like Wealthsimple Trade versus a big bank brokerage like BMO InvestorLine Self-Directed.

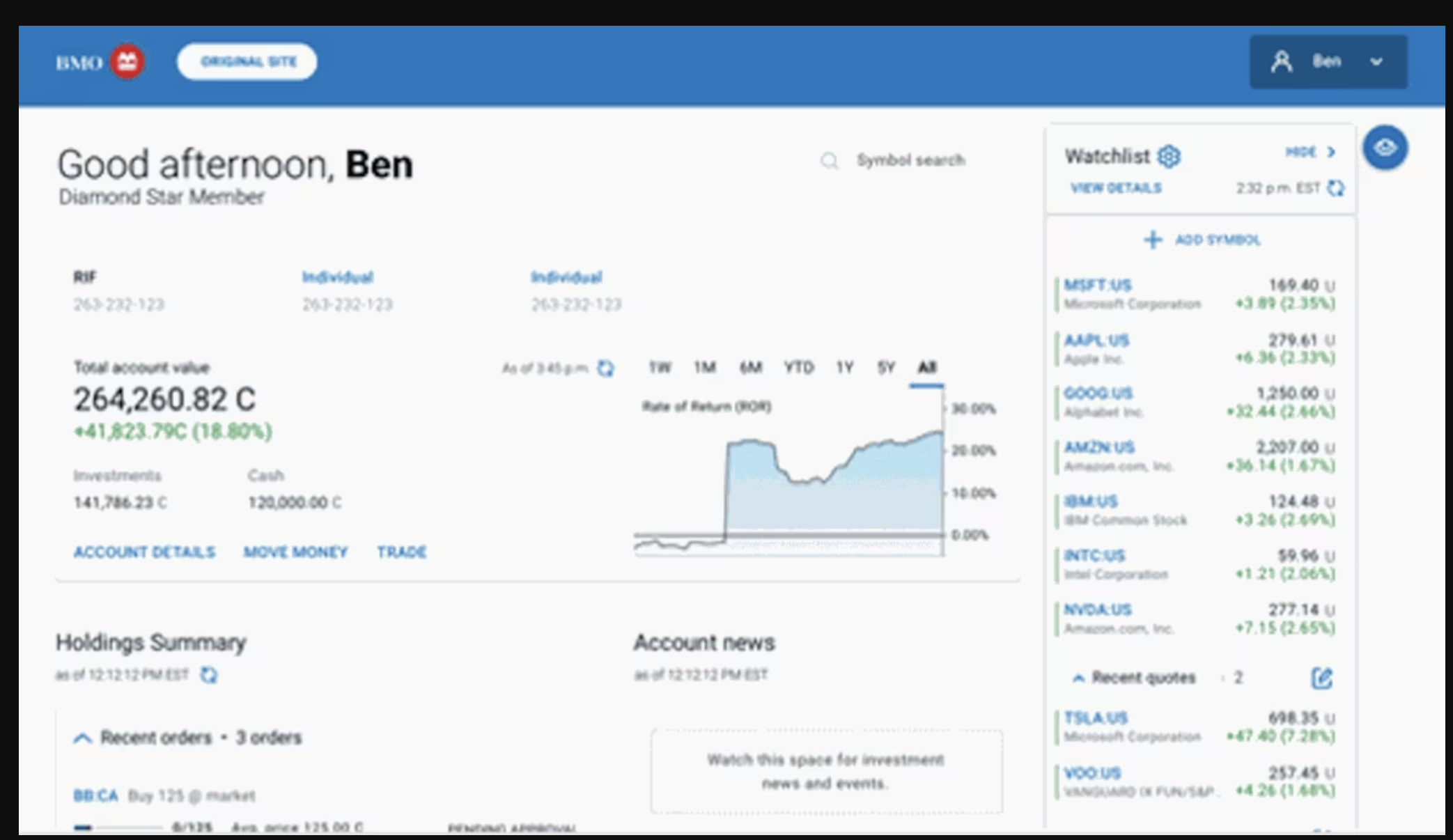

A look inside BMO InvestorLine Self-Directed

The redesigned BMO InvestorLine Self-Directed brings the self-directed investing platform up to the standard expected today from new and experienced investors.

The main dashboard allows you to easily see and navigate between your account types, track performance, set up personalized watchlists, and create a customizable view of your holdings. You can also see your entire portfolio’s performance at once, and place a trade from any screen.

Industry-leading research, market data, and professional-level tools are all accessible at your fingertips.

The customization is impressive because it allows new investors to ‘hide’ data and features that they don’t need or care about, while experienced traders can ‘turn on’ those features to see details like dividends, USD balances, and more.

Finally, BMO InvestorLine Self-Directed has improved its support features to include email and scheduling a call.

The bottom line: Is BMO InvestorLine Self-Directed worth it?

BMO InvestorLine Self-Directed received a long-overdue face-lift in 2019 to bring its user experience up to today’s standards.

If you’re an existing BMO banking client who has multiple account type needs beyond an RRSP and TFSA, and who trades infrequently, BMO InvestorLine Self-Directed is a terrific option for your self-directed investing needs. It’s also great for investors who plan to trade in U.S . listed stocks and ETFs since you can hold USD in registered accounts.

But if you’re a new investor who plans to contribute to your investment accounts often, you’re better off with a low-cost online broker like Questrade or Wealthsimple Trade. That’s because the $9.95 per trade pricing is tough to swallow when there are platforms that offer commission-free trading.

Learn MoreFAQs

Disclaimer

The content provided on Money.ca is information to help users become financially literate. It is neither tax nor legal advice, is not intended to be relied upon as a forecast, research or investment advice, and is not a recommendation, offer or solicitation to buy or sell any securities or to adopt any investment strategy. Tax, investment and all other decisions should be made, as appropriate, only with guidance from a qualified professional. We make no representation or warranty of any kind, either express or implied, with respect to the data provided, the timeliness thereof, the results to be obtained by the use thereof or any other matter.