Best AIR MILES credit cards in Canada

Fact Checked: Scott Birke

Updated: May 15, 2024

By using Air Miles credit cards along with an Air Miles membership card you can accelerate your Air Miles earn rate at one of the many participating Air Miles merchants in Canada.

Air Miles is one of Canada’s most popular loyalty programs, with over 100 merchants that participate in Air Miles. And Air Miles never expire and can be redeemed for so many different things from kitchen appliances, electronics and cash balances to flights and vacations, movie tickets, merchandise or other free items .

What are the best Canadian Air Miles credit cards?

BMO purchased the Air Miles program in July, 2023 so all Air Miles cards are now issued by BMO Bank of Montreal. While this limited the range of Canadian Air Miles cards available on the market, BMO is investing in the program to make its cards competitive with other rewards credit cards.

Best Air Miles credit card with high earn rate

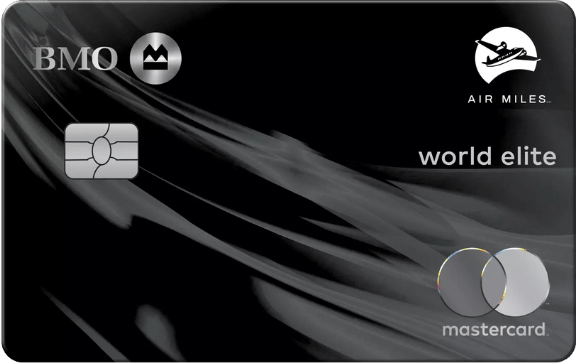

BMO AIR MILES®† World Elite®* MasterCard®*

Get 2,000 AIR MILES Bonus Miles and BMO will waive the $120 annual fee for the first anniversary*.

3x

Cardholders earn an accelerated 3x the Miles per $12 spent at participating AIR MILES partners*,

2x

2x the Miles for every $12 spent at any eligible grocery store*

1x

reward mile for every $12 in credit card purchases, everywhere you spend*

25%

discount on one worldwide AIR MILES flight redemption during the calendar year.*

Cardholders earn an accelerated 3x the Miles per $12 spent at participating AIR MILES partners*,

3x

2x the Miles for every $12 spent at any eligible grocery store*

2x

reward mile for every $12 in credit card purchases, everywhere you spend*

1x

discount on one worldwide AIR MILES flight redemption during the calendar year.*

25%

20.99%

Purchase APR

23.99%

Balance Transfer Rate

23.99%

Cash Advance APR 21.99% for Quebec residents

$120

Annual Fee

Purchase APR

20.99%

Balance Transfer Rate

23.99%

Cash Advance APR

23.99%

Annual Fee

$120

Excellent

Recommended Credit Score

$80,000

Required Annual Personal Income

$150,000

Required Annual Household Income

Recommended Credit Score

Excellent

Required Annual Personal Income

$80,000

Required Annual Household Income

$150,000

Pros

-

Offers the largest Air Miles sign-up bonus on the market with a waived annual fee for the first anniversary*

-

High earn rates of up to 3x the Miles on eligible purchases

-

Exclusive travel discounts like 25% off one worldwide AIR MILES flight redemption annually

-

Airport lounge access through complimentary Mastercard Travel Pass membership

-

Comprehensive insurance package which covers medical, trip, flight delay, lost luggage and more

-

Additional Perks include Boingo Wi-Fi, BMO Concierge, digital subscriptions, and cash back promotions

Cons

-

An $80,000 personal/$150,000 household income is needed to qualify

-

Ideal for AIR MILES loyalists, may not suit those with a casual approach

-

The fixed redemption value for flights may not appeal to everyone

-

Optimal value only when frequently shopping at AIR MILES partners

3x

Cardholders earn an accelerated 3x the Miles per $12 spent at participating AIR MILES partners*,

2x

2x the Miles for every $12 spent at any eligible grocery store*

1x

reward mile for every $12 in credit card purchases, everywhere you spend*

25%

discount on one worldwide AIR MILES flight redemption during the calendar year.*

Cardholders earn an accelerated 3x the Miles per $12 spent at participating AIR MILES partners*,

3x

2x the Miles for every $12 spent at any eligible grocery store*

2x

reward mile for every $12 in credit card purchases, everywhere you spend*

1x

discount on one worldwide AIR MILES flight redemption during the calendar year.*

25%

20.99%

Purchase APR

23.99%

Balance Transfer Rate

23.99%

Cash Advance APR 21.99% for Quebec residents

$120

Annual Fee

Purchase APR

20.99%

Balance Transfer Rate

23.99%

Cash Advance APR

23.99%

Annual Fee

$120

Excellent

Recommended Credit Score

$80,000

Required Annual Personal Income

$150,000

Required Annual Household Income

Recommended Credit Score

Excellent

Required Annual Personal Income

$80,000

Required Annual Household Income

$150,000

Pros

-

Offers the largest Air Miles sign-up bonus on the market with a waived annual fee for the first anniversary*

-

High earn rates of up to 3x the Miles on eligible purchases

-

Exclusive travel discounts like 25% off one worldwide AIR MILES flight redemption annually

-

Airport lounge access through complimentary Mastercard Travel Pass membership

-

Comprehensive insurance package which covers medical, trip, flight delay, lost luggage and more

-

Additional Perks include Boingo Wi-Fi, BMO Concierge, digital subscriptions, and cash back promotions

Cons

-

An $80,000 personal/$150,000 household income is needed to qualify

-

Ideal for AIR MILES loyalists, may not suit those with a casual approach

-

The fixed redemption value for flights may not appeal to everyone

-

Optimal value only when frequently shopping at AIR MILES partners

Best Canadian Air Miles credit card with no annual fee

BMO AIR MILES®† MasterCard®*

4.2

800 AIR MILES

Good

Get 800 AIR MILES Bonus Miles!* That’s enough for $80 towards purchases with AIR MILES Cash*

3 miles

Get 3 Miles for every $25 spent with AIR MILES Partners.

2 miles

Get 2x the Miles for every $25 at grocery stores and supermarkets.

4 miles

Double up your Shell Go+ Miles on eligible fuel and in-store purchases.

Get 3 Miles for every $25 spent with AIR MILES Partners.

3 miles

Get 2x the Miles for every $25 at grocery stores and supermarkets.

2 miles

Double up your Shell Go+ Miles on eligible fuel and in-store purchases.

4 miles

20.99%

Purchase APR

22.99%

Balance Transfer Rate 0.99% introductory interest rate for 9 months (fee applies)*

22.99%

Cash Advance APR 21.99% for Quebec residents

$0

Annual Fee

Purchase APR

20.99%

Balance Transfer Rate

22.99%

Cash Advance APR

22.99%

Annual Fee

$0

Good

Recommended Credit Score

$15,000

Required Annual Personal Income

Recommended Credit Score

Good

Required Annual Personal Income

$15,000

3 miles

Get 3 Miles for every $25 spent with AIR MILES Partners.

2 miles

Get 2x the Miles for every $25 at grocery stores and supermarkets.

4 miles

Double up your Shell Go+ Miles on eligible fuel and in-store purchases.

Get 3 Miles for every $25 spent with AIR MILES Partners.

3 miles

Get 2x the Miles for every $25 at grocery stores and supermarkets.

2 miles

Double up your Shell Go+ Miles on eligible fuel and in-store purchases.

4 miles

20.99%

Purchase APR

22.99%

Balance Transfer Rate 0.99% introductory interest rate for 9 months (fee applies)*

22.99%

Cash Advance APR 21.99% for Quebec residents

$0

Annual Fee

Purchase APR

20.99%

Balance Transfer Rate

22.99%

Cash Advance APR

22.99%

Annual Fee

$0

Good

Recommended Credit Score

$15,000

Required Annual Personal Income

Recommended Credit Score

Good

Required Annual Personal Income

$15,000

What are Air Miles?

Air Miles, also called air miles points, are a form of rewards points. You earn air miles by showing your membership card in participating online and brick and mortar stores, using an Air Miles credit card for any purchase, or by buying extra miles online. After you’ve collected enough miles you can redeem them for cash, movie tickets, flights, or other items. To learn more about the Air Miles program and how to earn and redeem, read our Air Miles Points guide.

Everyone always asks what their Air Miles are worth in cash terms, but it’s not so easy to answer. It depends on what you plan to redeem them for and where you go to redeem them. We estimate one Air Mile to be worth something between $0.12 and $0.194. That valuation is greater than what you can expect from cash back rewards, making card like these among the best credit cards for flights.

How to apply for an Air Miles credit card

The best Canadian Air Miles credit card is different for everyone, depending on your spending habits and financial situation. Here are some crucial features to look for:

- Annual fee

- Basic air miles earn rate

- Accelerated air miles earn rate and where you can earn

- Welcome bonus

- Additional special offers like discounts and travel insurance

- Interest rates for balance transfer

You might opt to simplify your selection process by using our automated Air Miles calculator. Just input your monthly spending and the features of the Air Miles credit card you’re considering, and the calculator will tell you how much value the credit card will give you in a year.

Summary: Best Canadian Air Miles credit card list

FAQs

BMO is not responsible for maintaining the content on this site. Please click on the Apply now link for the most up to date information

*Terms and conditions apply

Sarah Pritzker has been writing for Money.ca since 2017, and loves learning about the latest trends in Canadian personal finance.

Compare more great credit cards

- Best Canadian credit cards

- Best cash back credit cards

- Best travel credit cards

- Best balance transfer credit cards

- Best Rewards credit cards

- Best no annual fee credit cards

- Best low interest credit cards

- Best credit card promotions

- Best credit cards for rental car insurance

- Best student credit cards

Disclaimer

The content provided on Money.ca is information to help users become financially literate. It is neither tax nor legal advice, is not intended to be relied upon as a forecast, research or investment advice, and is not a recommendation, offer or solicitation to buy or sell any securities or to adopt any investment strategy. Tax, investment and all other decisions should be made, as appropriate, only with guidance from a qualified professional. We make no representation or warranty of any kind, either express or implied, with respect to the data provided, the timeliness thereof, the results to be obtained by the use thereof or any other matter.